Are You Decentralized?

More real estate opportunities are popping up on decentralized platforms than ever before. Take for instance Los Angeles. There are more industrial buildings sold “off-market” than on. Industrial real estate has always had a decentralized component. Brokers find a good lead. They shop it first to their best clients off-market, decentralized. And if unsuccessful, put it on the market, on a central, MLS-type server for all to search and see. The difference today is that blockchain and cryptography is an electronic evolution that will give customers new ways to profit from their real estate.

Peace on Earth

Can Crypto and Blockchain Secure your Commissions

If you had the experience of driving down the street and seeing a building where you should have been paid and were not, this simple technology is of note. As more deals move “off-market”, I want certainty of commission arrangements. Ruthless competition and extreme space shortages is an explosive combination. In this hyper-intense market, this is one example of how I prove Procuring Cause using Blockchain.

Continue reading “Can Crypto and Blockchain Secure your Commissions”

2021 Remains an Unbalanced Industrial Market

The industrial property business has grown from a real estate niche serving mostly large corporations and owner/users to a favored investment of large institutions. The rise coincided with the great manufacturing upheaval of shuttered plants as companies shifted production offshore. Goods return in containerized shipments and begat the new industry of logistics. The result was increased liquidity of both goods and capital. A situation that is ideal for warehouse development and investment. Today’s industrial marketplace is made up of global and national 3pls, shipping companies, e-commerce, and on the capital side, Industrial REITS, large investment funds, and a handful of developers. The Covid Supply Chain phenomena and an increase in tariffs has compounded an already unbalanced space market to acute levels

Continue reading “2021 Remains an Unbalanced Industrial Market”

MIT World Real Estate Forum – 2021

In July, the MIT Center of Real Estate held its virtual 2021 World Real Estate Forum. While each piece of information shared during the event was insightful, there were a few takeaways particularly useful for SIOR and CRE experts.

Continue reading “MIT World Real Estate Forum – 2021”

Return to Corporate Real Estate

There has been a resurgence of demand from Corporate Real Estate. Once, the most important sector of the industrial real estate business, corporate influence has waned in comparison to investor/developers. The fade of corporates is a long-term trend starting when manufacturing moved off shore in the 1980s. Since the Great Financial Crisis, Capital’s influence in industrial real estate has only become more pronounced as investors search for yield. Tenants are the crucial for cash flow, but where it counts the most, in the ownership rankings and at the negotiation table, Capital is the market leader.

Continue reading “Return to Corporate Real Estate”

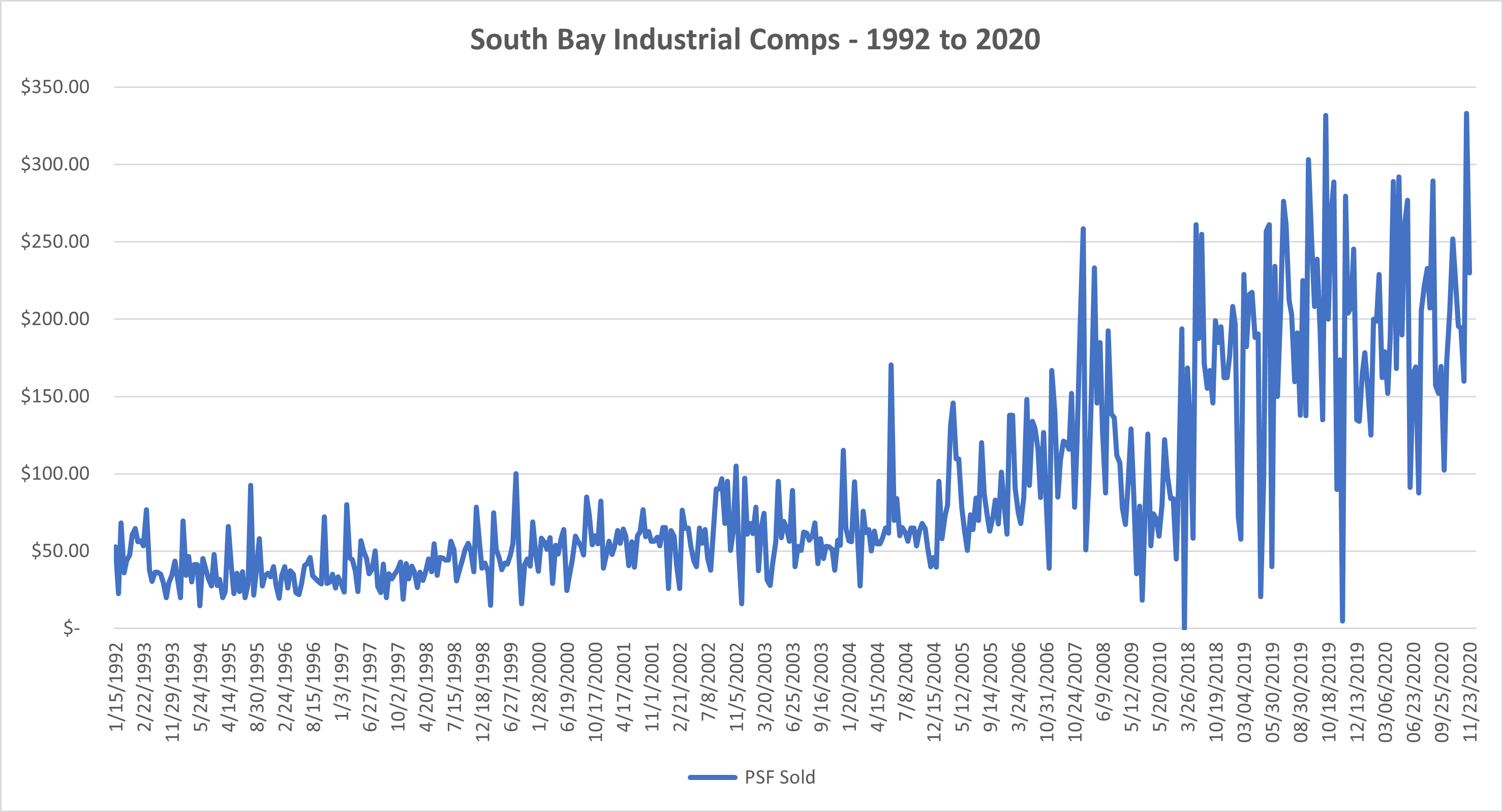

Why Is Industrial the Hot Investment

As 2020 comes to an end, Industrial Buildings continue to be good investments. With annual appreciation at 6% and current cap rates at 5%, Buyers are getting 11% annual returns and greater on an “all-cash” basis. These calculations reflect market conditions and not based on finding a “good deal”. With interest rates at 3% or lower, there is strong leverage boosting cash-on-cash returns to 10% with conservative financing. Levered returns increase to 15% (cash flow + appreciation). If you can find property for sale, not always that simple, conditions are very supportive.

Continue reading “Why Is Industrial the Hot Investment”

CREate 360 – Fall Conference

Twice a year I meet with my SIOR colleagues from around the world to make deals and compare markets. This was the first time we held the meeting virtually. While not the same as in-person, I was still able to connect with many of my peers and have valuable learning time.

Continue reading “CREate 360 – Fall Conference”