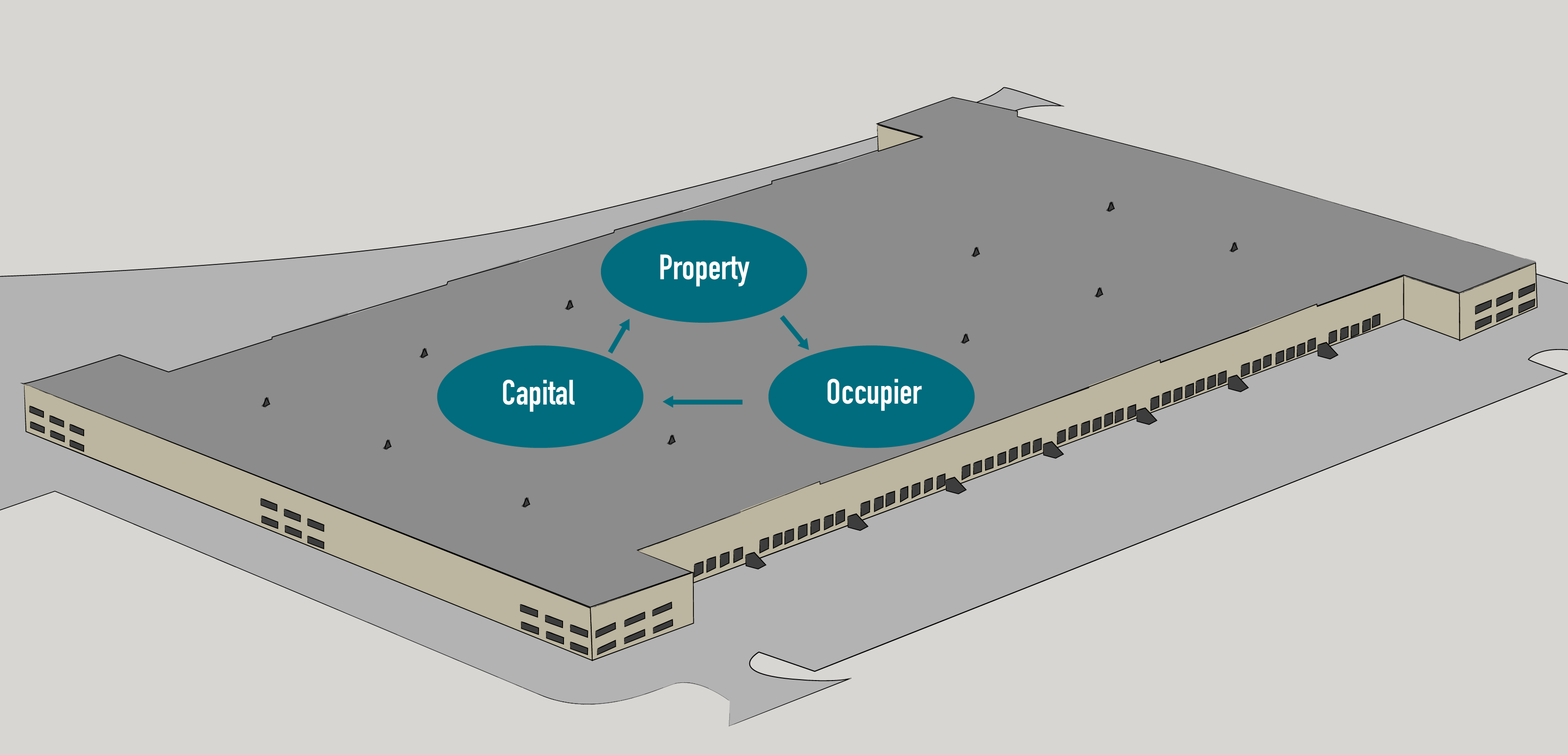

One of more popular strategies and entails less risk is to have an Occupier-In-Tow. It is very common in build-to-suits and sale-leasebacks where the Occupier can leverage their credit into favorable terms. Major corporations use this strategy when developing new distribution facilities. The sale leaseback has similar benefits by reducing investment risk and giving the corporate tenant more financial flexibility. Occupier-in-Tow reduces the cost of capital and removes uncertainty. Strong credit and long lease terms create the most promising deals. However, in times of distress, the sales leaseback will generate needed cash while keeping the business operational.