Week of June 2, 2020

Even after Covid-19, depressed economic numbers, and civil unrest, the mechanics of industrial real estate are still functioning. We are showing property, signing leases, and contracting to buy land and buildings. Although there is much lower demand and increased supply, pricing is generally at pre-covid levels. If there’s a difference, we now have a better selection of properties with excellent attributes. While it’s no longer a tight market, unusually low interest rates and monetary actions buttress asset prices.

There is a dichotomy in the market. In times of recession, there is a flight to quality. When availabilities increase, Occupiers can lock in a better building for a long-term lease under more favorable terms. Owners of Class A buildings are willing to make concessions especially for better credit tenants. Investment dollars feel safer in higher quality assets because those buildings lease the fastest. In contrast and pre-dating the current catastrophe, there was a pronounced “search for yield”, where any return beats negative interest rates. This investing philosophy of buying lower quality properties will persist because there is roughly a 5% spread (+appreciation) between B industrial and liquid funds. One the one hand, there is a flight to quality. On the other, any building with yield. One constant is location holds the property’s value more than any other determining factor.

One other thing is becoming clear on building occupancies during Covid-19. Many tenants are inspecting office and warehouses with an eye towards creating ventilation and fresh air. Hallways, circulation, common areas, and bathrooms will need greater space to reduce contact. For buildings that have kept up with ADA standards in building design or re-design, they can generally be adapted for post-covid-occupancy. Older buildings that have not been upgraded to current standards will require new, costly investment. Luckily, there is already a proven vernacular for upgrading older industrial buildings, with light, windows, and outside space.

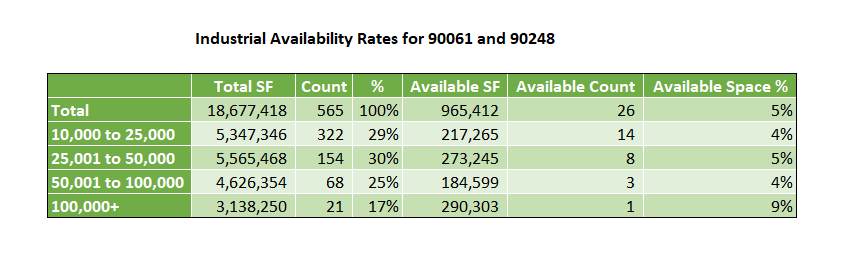

Availability Rates for the greater Gardena area is holding steady, mostly under 5% for all buildings sizes. One exception is the range of 100,000 square feet and larger and that is being thrown off by the Duke project of 300,000 Square Feet now at the early stages of construction.